Trading patterns in the financial markets are created by the action of traders and investors buying and selling positions in different time frames.

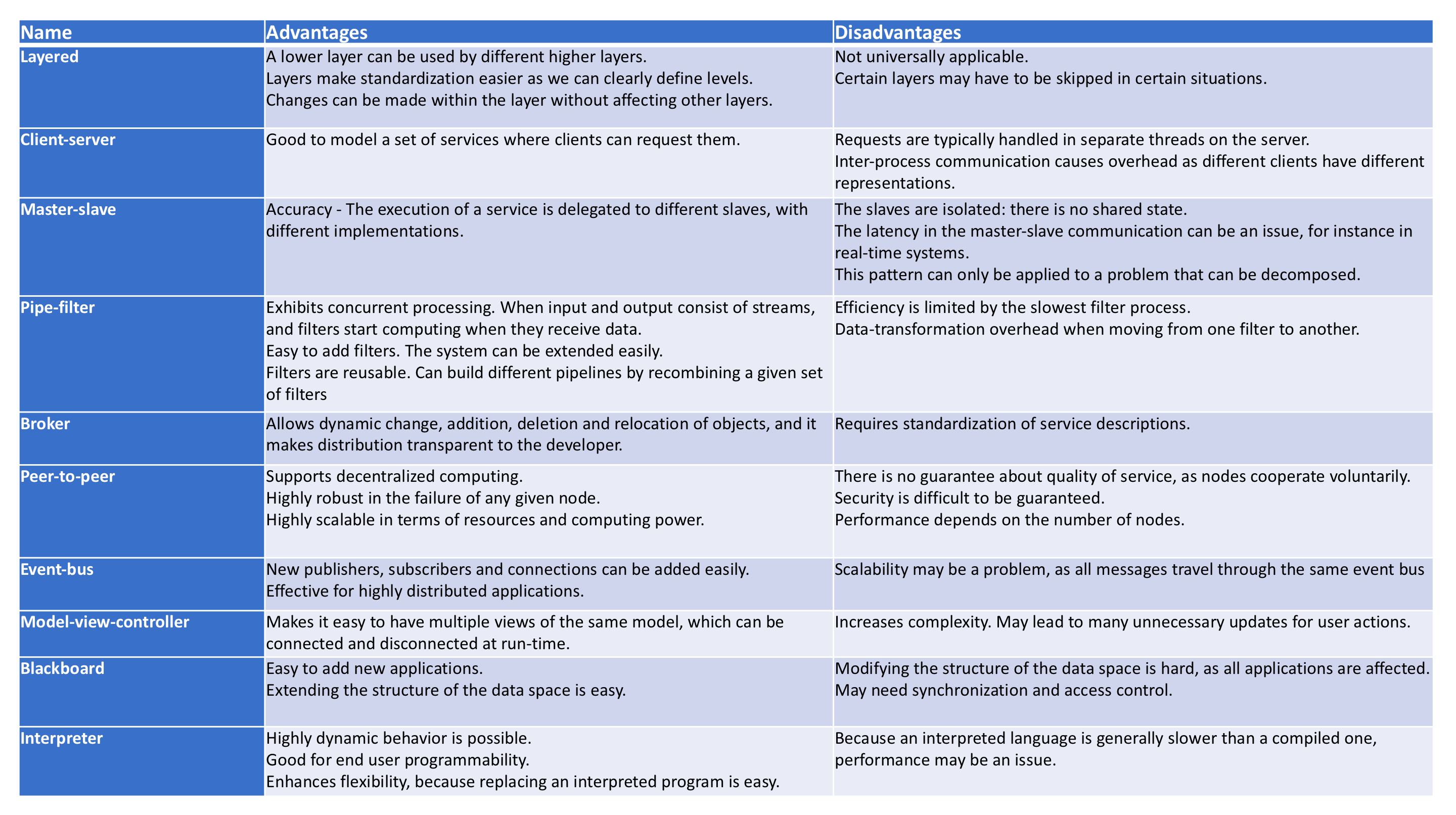

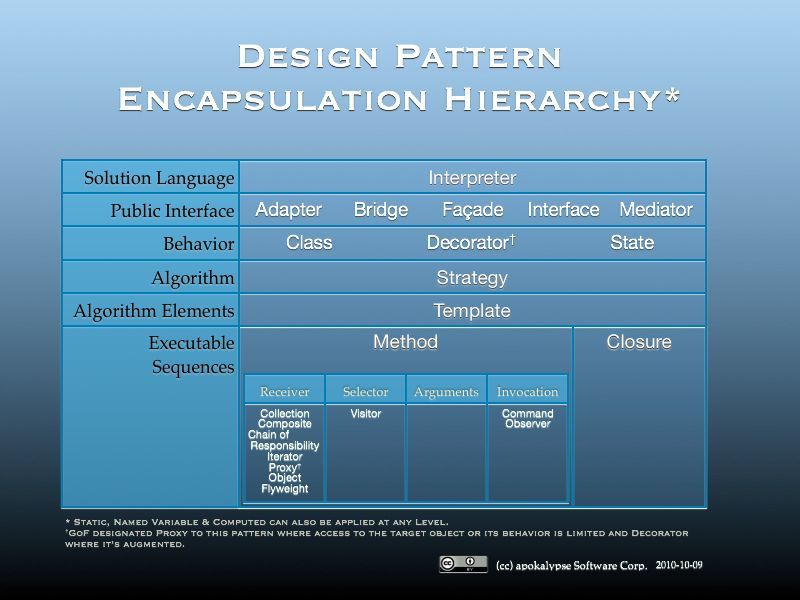

Design patterns are used to represent some of the best practices adapted by experienced object-oriented software developers. A design pattern systematically names, motivates, and explains a general design that addresses a recurring design problem in object-oriented systems. 15-214 2 Administrivia. Homework 6 checkpoint due Friday5 pm. Final exam Tuesday, May 3,5:30-8:30 pm, PH 100. Final review sessionSunday, May, 7-9 pm, DH 1112. Understanding how the patterns work, why they provide a benefit, and when to use them helps to ensure that software is built from reusable object oriented components. This DZone Refcard provides a quick reference to the original 23 Gang of Four design patterns, as listed in the book Design Patterns: Elements of Reusable Object-Oriented Software.

Here are the different types of patterns that emerge through buyers and sellers behavior.

- Buyers and sellers are always equal with every trade it is the price levels that they meet at that changes.

- Trend lines are vertical or horizontal resistance or support levels created by buyers and sellers inside a trend to create lower lows, higher highs, or price ranges.

- When buyers keep coming in at a price level you will see a key support level in a range.

- When sellers continually exit at a price level you will see a key resistance level in a range.

- Swings in price happen as sellers diminish at higher price levels and buyers come back in at lower price levels.

- Stocks have patterns of accumulation into weakness during uptrends.

- Stocks have patterns of distribution into strength during downtrends.

- Most trends in price are interrupted by trading ranges before the trend continues.

- A breakout of a long term trend trading range or trend line can signal the continuation or reversal of a trend.

- Charts are the visual creation of all traders and investors accumulated past actions of trading patterns.

Here are some common trading patterns in stocks.

Java design pattern cheat sheet. Computer Coding Computer Programming Computer Science Software Design Patterns Pattern Design Object Oriented Design Patterns. Design Patterns Cheat Sheet Here’s a quick cheat sheet for lots of design patterns. Post are linked to Java examples however they are not limited to a single Special thanks to Derek Banas.

Chart Patterns Cheat Sheet

Here is a historical pattern for a growth stock under long term accumulation until it ends and begins to go under a distribution stage. Chart courtesy of ChartPattern.com

Here is a chart of common bullish, bearish, and reversal trading patterns that play out in markets. The trend line break is their signal. Of course a trader must manage a trade taken with one of these breakouts using the right position sizing, stop loss, trailing stop, and profit target to be profitable.

A chart pattern is not a trading system just like a map is not a journey. It is the management of your trip that determines whether it will be good or bad.

For a full explanation behind the principles of these patterns check outThe Ultimate Guide to Chart Patterns.

C# Design Patterns Cheat Sheet